Course catalog

Categories

Showing 1-20 of 56 items.

Behavioral Finance Foundations

Learn how behavioral finance—the psychology of investing—can lead to better financial decisions and investments.

Business Financials Explained

Explore common misperceptions about financial planning, learn about different revenue and cost projection models, and use worksheets to build the statements that matter most.

Corporate Finance Foundations

Learn the basics of corporate finance and its impact on decision-making and growth.

Corporate Finance: Robust Financial Modeling

Explore how to create robust financial models to present company finances to stakeholders, empowering more informed decision-making.

Corporate Financial Statement Analysis

Learn the ins and outs of financial statement analysis—the examination of relationships among financial statement numbers—to gain insights into your company's past and future.

Credit Secrets for Entrepreneurs

Use business and personal credit to launch your business. Learn how business credit reports work, how to boost your credit score, and how to gain access to funding.

Economic Indicators Weekly

Learn how to find and interpret data about key economic indicators, such as unemployment, GDP, and home sales, in order to make better professional and financial decisions.

Economics for Business Leaders

Learn how to track major economic data points and understand changes in the economy to make more informed business decisions.

Economics for Everyone: Understanding a Recession

Learn how recessions impact industries, jobs, investments, and companies. Find out what can be done when economic downturns impact workers, consumers, financial markets, and more.

Evaluating Business Investment Decisions

Learn how to fairly evaluate business investment decisions and minimize the financial risks for your organization.

Evaluating College as an Investment

Get tips for finding your dream career, getting your college paid for (without loans!), and looking at higher education with an investor's mindset.

Excel for Corporate Finance Professionals

Discover how to use Excel for essential tasks required in corporate finance. Learn how to pick investments, determine your cost of capital, and perform operational budgeting.

Excel for Investment Professionals

Leverage Excel to make sound investments. Learn how to perform key investment-related activities in Excel, including investment evaluation and analysis on a stock or portfolio.

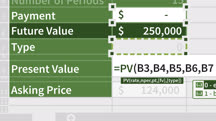

Excel: Financial Functions in Depth

Learn to use Excel functions for financial analysis. Find out how to calculate loan payments, depreciation, rate of return, and more, in Microsoft Excel.

Excel: Management Accounting

Learn how to use Excel for key managerial accounting tasks. In this hands-on course, explore performing variance analysis, doing activity-based costing, and using ratio analysis.

Excel: Tracking Data Easily and Efficiently

Learn how to build a super-charged Excel spreadsheet to easily track any kind of data -from sales activity and inventory levels to household spending.

Finance Foundations for Solopreneurs

Learn the finance fundamentals for running a business of one. This course is helpful for solopreneurs working in the on-demand economy.

Financial Adulting

Take control of your finances and get out of debt, regardless of your life stage. Learn how to budget, spend, and save money like an adult.

Financial Basics Everyone Should Know

Learn how to effectively navigate your finances to ensure you have a successful financial future. This course discusses savings, investments, insurance, and retirement.

Financial Modeling and Forecasting Financial Statements

Learn how to create forecasted financial statements for your company, including forecasted income statements, forecasted balance sheets, and forecasted statements of cash flow.