Course catalog

Categories

Showing 6,981-7,000 of 9,136 items.

QuickBooks Payroll Essential Training (228324)

Master QuickBooks Payroll with these tutorials from QuickBooks Payroll expert Bonnie Biafore. Start by learning how to set up an account and enter company and employee payroll data; then define federal, state, and local payroll taxes and work with various accounts and payroll items. If you're starting with Payroll midyear, she also explains how to add year-to-date data. The final chapters show how to run payroll, prepare payroll tax forms, and generate reports.

Note: This course covers only the US versions of QuickBooks Desktop and Payroll.

Note: This course covers only the US versions of QuickBooks Desktop and Payroll.

QuickBooks Pro 2010 Essential Training

How to use this popular business accounting software to manage business finances more efficiently.

QuickBooks Pro 2016 Essential Training

Learn how to best work with QuickBooks Pro 2016, from setting up a new chart of accounts to recording payments and running reports.

QuickBooks Pro 2017 Essential Training

Learn how to create and back up your company's QuickBooks file and quickly set up shop.

QuickBooks Pro 2018 Essential Training

Learn QuickBooks Pro 2018. Find out how to create and back up your company's QuickBooks file and quickly set up shop.

QuickBooks Pro 2019 Essential Training

Get up and running with QuickBooks Pro 2019. Find out how to create and back up your company's QuickBooks file and quickly set up shop.

QuickBooks Pro 2020 Essential Training

Learn QuickBooks Pro 2020 for small business accounting. Find out how to create and back up your company's QuickBooks file and quickly set up shop.

QuickBooks Pro 2021 Essential Training (234291)

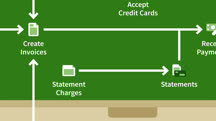

Do you wonder how to create and back up your company's QuickBooks file and quickly set up shop? Or how to add your banking information, credit cards, and historical data to the chart of accounts? How about how to set up your customers, vendors, employees, and inventory items? In this course, instructor Jess Stratton answers all these questions and more. Jess goes over the day-to-day operations that keep your business running: creating estimates, invoices, and sales receipts; processing payments; recording deposits; and printing checks. She covers how to run reports; find data about your business; and close the books, with end-of-year preparations. Jess concludes with a discussion on how to customize QuickBooks to meet your company’s specific needs as efficiently as possible.

QuickBooks: Advanced Bookkeeping Techniques

Get tips and techniques for recording tricky income, expense, and banking transactions in QuickBooks.

QuickBooks: Setting up a Company File In Depth

Learn how to set up a new file in QuickBooks, whether starting from scratch or importing records from another accounting platform.

R Essential Training Part 2: Modeling Data

Learn how to model data in R, one of the most important tools available for data analysis, machine learning, and data science.

R Essential Training: Wrangling and Visualizing Data

Learn how to wrangle data and create meaningful visualizations with R, the programming language powering modern data science.

R for Data Science: Lunchbreak Lessons

Learn R on your lunch break. This weekly series reviews the language features, development tools, and libraries that will make you a more productive R programmer.

R for Excel Users (217053)

Data scientists who use Excel realize that R is emerging as the new standard for statistical wrangling (especially for larger data sets). This course serves as the perfect bridge for the many Excel-reliant data analysts and business users who need to update their data science skills by learning R. Much of the course focuses on how crucial statistical tasks and operations are done in R—often with the DescTools package—as contrasted with Excel functions and Data Analysis add-in, and then scales up from there, showing the more powerful features of R. Conrad Carlberg helps you effectively toggle between both programs, moving data back and forth so you can get the best of both worlds. Learn about calculating descriptive statistics, running bivariate analyses, and more.

R Programming in Data Science: Dates and Times

Learn how to format, compare, calculate, manage, and troubleshoot dates and times using R-based tools.

R Programming in Data Science: High Variety Data

High-variety data can cause a slew of problems for data scientists. In this course, learn what these problems are and how to use the unique capabilities of R to solve them.

R Programming in Data Science: High Velocity Data

Learn how to work your mojo on high-velocity data with R. Discover how to acquire, process, and present high-velocity data using this popular programming language.

R Programming in Data Science: High Volume Data

Analyze high-volume data using R, the language optimized for big data. Learn how to produce visualizations, implement parallel processing, and integrate with SQL and Apache Spark.